The Neins

When Cain hears people chanting “Nine, nine, nine,” he welcomes it as a show of support for his, now famous, 9-9-9 tax code. He’s been making many appearances in the media lately, insisting that his tax code has garnered a grassroots movement of support. Though, if you ask me, he’s obviously confused.

I’m convinced it is far more likely that, on the day Cain heard the crowd chanting “9, 9, 9!” his crowd was primarily made up of recent German immigrants who were actually chanting “Nein, nein, nein!” or “No, no, no!”

I have, however, seen a grassroots movement gaining a lot of momentum across the world; the 99% or the Occupy Wall Street (#OWS) movement. A group of people who are speaking out against injustices in taxation, income disparity, corporate greed, and abuse of power.

I doesn’t make sense that anyone who would even mildly suggest an innuendo meant to possibly indicate support for #OWS would also support Cain’s 9-9-9 tax plan.

9-9-9, as Cain puts it, is a “replacement tax code.” It’s intended to replace taxes such taxes as the federal sales tax, capital gains tax, death tax, corporate income tax, payroll tax, and personal income tax.

Ready for some rhetorical questions? I hope so.

Did you catch that? The federal sales tax? There is no such thing! Cain is going to add on another 9% sales tax to everything you are already paying a state sales tax on. Want to buy a $10,000 vehicle? If your state has a 7% sales tax, you’ll pay $10,700 for that vehicle. When Cain adds another 9% on top of that? You pay $11,600 for the same vehicle.

Cain wants the capital gains tax (CGT) reduced to 9%? I say reduced because, after the Bush/Obama tax cuts expire in 2012, CGT will be 15%.

Cain wants to reduce the inheritance tax- oh, i’m sorry, the death tax- to just 9%? As of January 1st, 2011, estates valued at $5 million for an individual and $10 million for a couple are taxed at a rate of 35%. Cain expects people railing against greed to support a tax that nearly eliminates taxes on millionaires? I don’t think so.

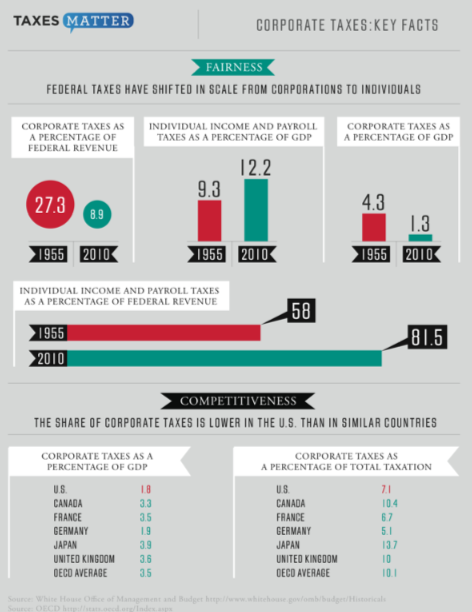

Cain wants corporate income tax to be reduced to 9% too!? Has he even seen an #OWS protest? Is he aware that they’re acting out in order to raise corporate taxes? Since the year 2000, corporate income tax has become less and less a part of our government revenue stream and, simultaneously, personal income tax and payroll taxes have been equally on the rise. While the US swims in 15 Trillion dollars of debt, it’s would-be-GOP-leader wants to provide another hefty tax cut to the most able-bodied source of revenue in the country.

Okay, so now that we know Cain wants to effectively gut taxes for those individuals and companies with the most resources – what would 9-9-9 do for you (presumably) and me?

Under a Cain administration, a new federal payroll tax would impose an additional 9% tax on everything you earn. In addition to you state taxes, your social security tax, etc – here’s a brand new tax for the american worker.

Personal income taxes would be set to a flat 9% tax which, for the 49% of Americans who currently pay less in payroll taxes, would mean an increase in taxation. That translates to less money on pay day.

To recap: Cain wants you to pay more to buy goods and have less in your pay check but he wants to provide tax cuts for the wealthiest Americans and corporations. Maybe I’m experiencing a little deja vu but – isn’t this just the same old Republican plan dressed up in made to look pretty?

But the person to tell you about Cain’s plan is Herman Cain himself. The transcript below can be found, within the video that follows at, the 5 minute mark.

CAIN: There is a huge amount of public support for 999. Just talk to anybody. This is what’s going to help us get it passed. The public support.

GREGORY: I just want to break that down. So you’re acknowledging this morning, which I haven’t heard you do before, that there are individuals who are going to pay more in taxes.

CAIN: There are some, yes.

GREGORY: And you think those people are going to rally around tax reform where the wealthy pay less and middle-class and lower-income folks pay more.

CAIN: Yes.

It’s also worth noting that Herman Cain has ties to the infamous Koch brothers; recently a key component in the firing of public service workers, reduced wage, the illegal revocation of union bargaining rights, and the loss of worker pension and benefits in Wisconsin.

After taking all of this into consideration, is anyone surprised?

If there is on thing Herman Cain and I can agree on when it comes to his tax code, it’s that you should do the math. Go ahead.

Comments are closed.